Introduction

The journey from turning an idea into a thriving online business is filled with challenges and opportunities. One key metric that can significantly influence your startup’s financial health is the Gross Profit Ratio. This ratio offers insights into how well you are managing costs relative to sales, which in turn impacts your overall profitability.

Understanding this crucial financial efficiency indicator can help entrepreneurs make informed decisions, refine their business strategies, and ultimately achieve competitive advantage. In this comprehensive guide, we’ll explore what Gross Profit Ratio is, why it matters for startups, and how you can calculate and optimize it to boost your startup finance.

What is the Gross Profit Ratio?

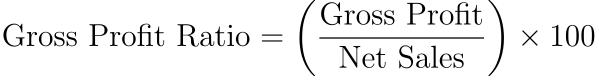

The Gross Profit Ratio (GPR) measures a company’s financial efficiency by comparing gross profit to net sales. It indicates the percentage of revenue that exceeds the cost of goods sold (COGS), reflecting how effectively a business controls its production costs relative to its revenues.

Formula:

Where:

- Gross Profit is calculated as Net Sales minus Cost of Goods Sold.

- Net Sales refers to the revenue from sales after deducting returns, allowances for damaged or missing goods, and any discounts allowed.

Importance of Gross Profit Ratio for Startups

For startups, maintaining a healthy Gross Profit Ratio is vital for several reasons:

- Financial Health Indicator: A strong GPR suggests that a startup efficiently controls its production costs, which can lead to increased profitability over time.

- Resource Allocation: Understanding your GPR helps in allocating resources more effectively, ensuring that funds are directed towards areas that generate the most profit.

- Pricing Strategy: It provides insights into how pricing structures affect profitability and assists in setting competitive yet profitable prices.

- Expense Management: By monitoring this ratio, startups can identify cost-saving opportunities, optimizing their expense management strategies.

Calculating Gross Profit Ratio: A Step-by-Step Example

To illustrate the calculation of Gross Profit Ratio, let’s consider a hypothetical startup that sells handmade jewelry online.

- Net Sales: Suppose in one financial quarter, the company generated net sales amounting to $50,000.

- Cost of Goods Sold (COGS): The cost associated with producing and delivering these products is $30,000.

- Gross Profit Calculation:

- Gross Profit = Net Sales – COGS

- Gross Profit = $50,000 – $30,000 = $20,000

- Gross Profit Ratio Calculation:

- GPR = (Gross Profit / Net Sales) x 100

- GPR = ($20,000 / $50,000) x 100 = 40%

In this example, the startup has a Gross Profit Ratio of 40%, meaning that 40% of its sales revenue is retained after covering the cost of goods sold.

Strategies to Improve Your Gross Profit Ratio

Optimizing your GPR involves several strategic approaches:

- Cost Optimization: Regularly review and negotiate supplier contracts, streamline production processes, and reduce waste to lower COGS.

- Pricing Structure: Implement a pricing strategy that covers costs while remaining competitive in the market. Consider value-based pricing models that reflect customer perception of your product’s worth.

- Product Mix Analysis: Focus on selling higher-margin products or services to boost overall profitability.

- Operational Efficiency: Invest in technology and training to improve operational efficiency, reducing production time and costs.

The Role of Accounting Strategy in Monitoring Gross Profit Ratio

An effective accounting strategy is crucial for accurately tracking financial performance metrics like the GPR. It involves:

- Implementing robust accounting software that provides real-time data analysis.

- Regularly reviewing financial statements to monitor trends and deviations in profitability metrics.

- Setting up key performance indicators (KPIs) aligned with business goals, including the Gross Profit Ratio.

Conclusion: Turning Your Idea into a Profitable Business

Understanding and optimizing your Gross Profit Ratio is essential for turning an idea into a successful online business. By focusing on financial efficiency, strategic pricing, and cost management, startups can enhance their profitability metrics and ensure long-term sustainability.

At ideato.biz (https://ideato.biz), we specialize in helping entrepreneurs turn their ideas into thriving businesses. Our services encompass comprehensive financial guidance, including optimizing your Gross Profit Ratio to maximize business revenue. With our expertise, you’ll gain a competitive advantage in the market, ensuring that your startup not only survives but thrives in today’s dynamic economic landscape.

Leave a Reply